The Impact of Tariffs on Supply and Demand | Hidden Costs You Should Know

Updated On 3 Aug, 2025

Introduction

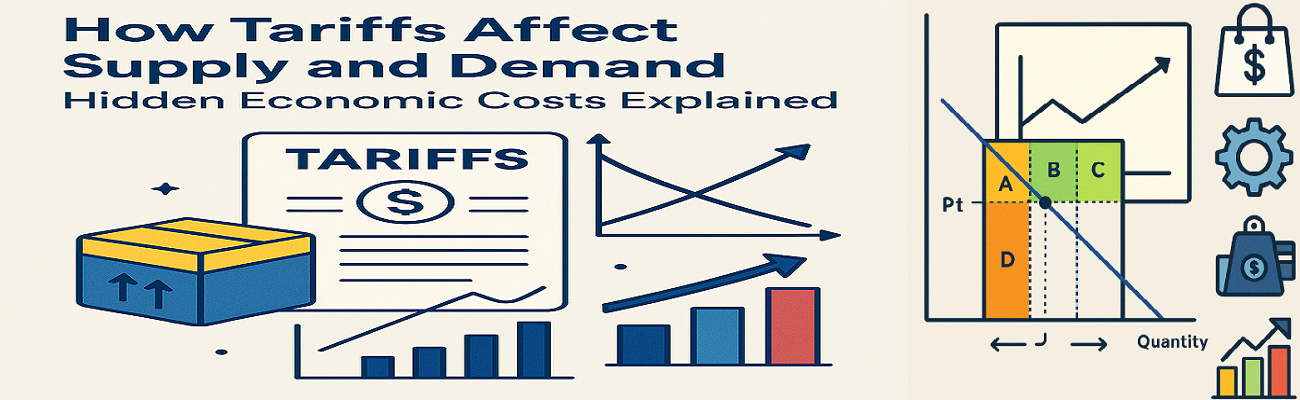

In today’s increasingly interconnected world, tariffs have become a hot-button issue in both economic and political conversations. While often introduced to protect domestic industries, tariffs can lead to significant unintended consequences—impacting supply chains, altering demand, and hurting your wallet. Let’s dive into what tariffs really are and how their hidden costs ripple across global markets.

What Are Tariffs, Really?

A tariff is a tax imposed by a government on imported goods. The goal is to make foreign products more expensive, giving local industries a price advantage. While this may sound beneficial, the actual outcomes are far more complex and often damaging to both businesses and consumers.

How Tariffs Disrupt Supply and Demand

Reduced Supply of Imported Goods

When tariffs drive up the cost of imported items, businesses may scale back or stop importing altogether. This leads to shortages, supply chain delays, or even product unavailability—especially in industries that depend heavily on foreign components or raw materials.

Increased Prices for Consumers

With fewer goods available and higher import costs, prices often rise. This contributes to inflation, decreasing consumers’ purchasing power and raising the cost of living across the board.

Shift in Demand Behavior

Tariffs can influence consumers and businesses to change their purchasing behavior. This might mean switching to lower-quality substitutes, delaying purchases, or abandoning certain products completely—disrupting predictable market patterns.

The Hidden Costs You Don’t See Immediately

- Higher Operational Costs for Businesses: Companies relying on global suppliers may face rising costs for raw materials, which are often passed on to customers.

- Reduced Global Competitiveness: Using pricier or inferior domestic alternatives can reduce the appeal of products in international markets.

- Retaliation and Trade Wars: Other nations may retaliate with their own tariffs, sparking broader trade conflicts and deeper economic disruption.

- Job Loss in Downstream Industries: While some industries benefit, others suffer. For instance, tariffs on steel may help domestic steelmakers but hurt automakers and construction firms that rely on affordable steel.

Real-World Example: U.S.–China Trade War

During the 2018–2019 U.S.–China trade conflict, American farmers, retailers, and tech companies felt the pressure:

- U.S. agricultural exports to China dropped significantly.

- Tech companies faced component shortages and rising production costs.

- Consumers paid more for products like washing machines, smartphones, and electronics.

Conclusion: Tariffs Come With a Price

Tariffs may seem like a quick fix for protecting domestic industries, but their long-term economic consequences are often damaging. From inflated consumer prices to reduced business competitiveness and global trade tensions, the hidden costs of tariffs are real—and growing.

Whether you're a business owner, policy maker, or everyday consumer, understanding the ripple effects of tariffs is crucial in navigating today's global economy.

Check : EDI Partner List Here : https://www.cogentialit.com/tradingpartners